Dealing with the aftermath of a hurricane can prove just as overwhelming as going through one. When all the wind and rain dissipate, you’re left to literally and figuratively pick up the pieces. If you sustained damage to the interior or exterior of your home or lost your home altogether, you need to know your options for a recovery—and get a payout as soon as possible.

However, you likely don’t have time to haggle with the insurance company when there’s a tree in your window, holes in your roof, and a third of your home is underwater. When searching for a safe place to bring your family when you cannot inhabit your home, you can’t afford delays in processing your claim.

Dolman Law Group can help you. Our Florida hurricane damage lawyers can handle your claim. Contact us today for a free consultation and to get started.

Dolman Law Group Can Take Care of Your Hurricane Damage Claim

During this precarious time, you likely count on the insurance money to cover your losses from the hurricane. But, unfortunately, you may have some major challenges ahead. First, the insurance company will focus on their bottom line. Second, they may delay your claim with the influx in hurricane damage claims from others in similar circumstances as you.

Both elements can make it difficult for you to quickly receive the money you deserve. Handling your insurance claim alone may not yield the results you need. With an attorney to take on your claim, you could have more resources to seek a fair financial recovery.

Enlisting the help of our attorneys can benefit you because:

- We know the law: Nearly two decades in the Florida legal system have given us in-depth knowledge of the insurance laws and homeowners rights that affect your claim.

- We have attorneys who get results: Our firm has recovered hundreds of millions of dollars for clients since we opened our doors.

- We have the finances to protect your interests: We can dedicate the resources to properly investigating your claim and building your case with solid evidence and experts. We have the budget to do it.

- We understand hurricane insurance policies: The language can prove confusing for someone unfamiliar with the legalese in these contracts. We can simplify it, explain what you need to know, and apply the provision accurately to your claim.

- We know insurance adjusters’ tactics: We are acquainted with the techniques adjusters use to keep the insurer’s pockets full.

What Our Florida Hurricane Damage Attorneys Do to Help Your Insurance Claim

We handle every facet of your claim, so there’s nothing you have to worry about. It’s our duty to handle your case with care. For us, that means we will:

Analyze Your Insurance Policy In-depth

We carefully analyze the policy and interpret the language so we can explain your provisions and seek a recovery efficiently.

Investigate the Damage

Our hurricane damage lawyers can launch a detailed investigation to uncover the cause of the damage to your home or commercial property. We gather the evidence required to link your losses to the specific source of hurricane damage.

During our investigation, we also work to identify all the areas of your home that sustained damage and the additional losses you’ve suffered. For example, if you lost personal property or valuable documents or need to reside somewhere else temporarily, you should account for these issues in your insurance claim.

Prepare Your Hurricane Damage Claim

We can handle the preparation of the claim forms and additional paperwork, including the proof of ownership, proof of loss, and related financial documents. If you have not already started this process, we can ensure that you have the documentation you need of your property’s damage.

Work With Experts

The hurricane damage lawyers on our team don’t cut corners when it comes to building your claim. We can work with reputed professionals in damage repair and water restoration who understand the effects of wind and rain on your home. These experts can pinpoint damage that might go overlooked and provide solutions. We can also bring on property damage appraisers and other experts to accurately value your losses.

Safeguard Your Rights

It’s our primary job to protect the rights of each client. We know what kind of treatment you deserve under state law. You have a right to fair compensation and a timely payout under your insurance policy.

A Florida hurricane claims lawyer can protect those rights by:

- Negotiating a fair settlement offer for your damages and rejecting offers that don’t meet the mark

- Using state law to interpret your insurance policy fairly and in your favor

- Handling communications with the insurance company so they cannot take advantage of you

- Providing legal guidance to facilitate decision-making throughout your claim and your dealings with the insurer.

Protect You Against Bad Faith Practices

When insurers don’t play fair, you need someone to keep them honest. Our hurricane damage claims lawyer protects you from the bad faith conduct of insurance companies. We can work to ensure that your case moves forward, show what you deserve based on your policy’s terms, and take the insurer to court when its actions violate the law.

See Your Case Personally

When we fight for our clients, we put ourselves in their shoes. We know how to do that as Florida residents and attorneys who lived through and assisted clients in the aftermath of the state’s hurricanes, from Ivan to Ian. We stand committed to giving you the personal attention necessary to understand your needs and investigate your claim adequately. Our insurance claims lawyers examine the damage up close and fight tirelessly to help you recover financially.

Go After Results Through Litigation

We do not operate like a settlement mill. Our firm isn’t looking to make a quick buck off clients at their most vulnerable time. Instead, we believe in fighting for just compensation under your hurricane insurance policy and settling when it makes sense for you. We push back when insurance companies undervalue, delay, or deny your claim.

Attorney Stanley Gipe leads our passionate litigation team as an award-winning, Board-Certified Trial Litigator. Our hurricane damage attorneys can take your case to trial to achieve results.

Use Our Resources to Propel Your Case

We can allocate the financial resources to hire experts, conduct a comprehensive investigation into your hurricane damage, and sustain a court battle with insurers. We have a wide-reaching network that we can tap into to build strong cases. Insurance companies know we go all in for our clients.

At Dolman Law Group, We Prioritize Clients

For nearly two decades, we’ve fought for clients facing personal injury and property damage. Our Florida property damage attorneys have recovered millions of dollars for clients since our founding. This includes money that helped individuals and families pay for medical expenses, relocation, and the restoration of their homes. We have more than 20 offices in Florida and around the United States to better serve those who need our help.

Managing Partners, Attorneys Matthew Dolman and Stanley Gipe, lead a diverse legal team of compassionate and hard-working litigators who put clients’ needs first. We take pride in being a law firm built on a passion for the law and getting top results for the people who call on us for help.

We’ve never been about solely making money. We make it a priority to support our clients, and we diligently work to build cases that compel just compensation. Attorney Dolman founded our firm to provide legal representation that people could trust.

Recognition for Our Passionate Legal Service

Because of our focus on client service and results, our clients and the legal community have recognized members of our legal team with accolades like the ones below:

- Avvo “Clients Choice for Personal Injury”

- Top 40 Lawyers—American Society of Legal Advocates

- Top 100 Trial Lawyers—The National Trial Lawyers

- Florida Super Lawyer

- Legal Elite by Florida Trend Magazine

Hurricane Ian Damage Claims – Your Insurance Claim

Our firm is prepared to assist policyholders on a wide variety of residential and commercial property hurricane damage claims, including:

- major roof damage

- minor roof damage

- floor damage

- damage to the foundation of a home or business

- exterior wall damage or wall collapse

- interior property damage

- collapsed wall(s)

- wall splintering

- deck damage

- garage damage

- siding damage

- damage to major appliances

- deeply rooted trees that have been uprooted

- damaged landscaping

It is not uncommon for policyholders to file supplemental claims to cover issues spotted after the initial claim has been submitted.

Steps to Take After Hurricane Damage

Dealing with the aftermath of a hurricane can be overwhelming and stressful, especially when you’re faced with property damages. If you’ve been affected by a hurricane and suffered damages to your property, you may be wondering what to do next.

Here are some things to keep in mind after a hurricane:

- Find a temporary residence if you can’t live in your home. You may have to relocate to a hotel temporarily while your house is being repaired.

- Take safety measures. Open windows and doors and turn off all utilities at the main switches or valves if told to do so by authorities.

- Protect your property and document the efforts. Your insurance policy requires that you prevent additional damage to your property, and you should document your efforts immediately after the hurricane hits.

- Take photos and videos. Document all damage, including structural issues and personal belongings destroyed or damaged by wind, rain, or flooding. If possible, take photos while it’s still raining or immediately after the rain stops so you can show that the damage occurred during the storm.

- Keep all receipts. Once you receive approval from your insurance company for repairs or replacement, save any receipts for work done, supplies purchased, and temporary housing costs if necessary.

- File your claim promptly. Contact your insurance company as soon as possible to file a claim for property damages caused by a hurricane. You should also submit your proof of loss within the shortest time possible.

- Contact an attorney. If Hurricane Ian, Irma, or Harvey damaged your home, you should contact an attorney to guide you through the claim process.

Categories of Hurricanes

We’ve all heard of hurricanes, and most people are familiar with the five categories of hurricanes. It’s important to understand these categories to adequately protect yourself, your family, and your properties during these storms.

It’s essential to know the difference between the following categories if you find yourself on the verge of having your home or business destroyed by a hurricane in Florida:

- Category 1: A category one hurricane has sustained 74-95 mph winds. These are the hurricanes that make landfall and cause minimal damage.

- Category 2: These hurricanes have winds from 96-110 mph but lack the power to make landfall. These hurricanes cause heavy damage to structures but no casualties.

- Category 3: These hurricanes leave the Gulf of Mexico and become post-tropical storms. The winds may die down a bit, but plenty of damage still exists. They often leave behind tornadoes, which are devastating to lives and property.

- Category 4: A category four hurricane has winds greater than 125 mph. These are tropical cyclones that remain over land for an extended period (over 48 hours). They may cause heavy damage, casualties, and prolonged power outages.

- Category 5: These are storms with sustained wind speeds greater than 157 mph at the center. This classification is reserved for hurricanes that will likely result in catastrophic damage when making landfall.

Hurricane Ian Property Damage and Your Insurance Policy

Property damage inflicted by category 3 Hurricane Ian should be covered by your homeowner’s insurance policy. Generally, any homeowners insurance policy sold in Florida is subject to a hurricane or wind deductible.

Flood Insurance Differs From Hurricane Insurance

You may find your homeowners insurance policy coverage is not sufficient to handle all of the damage sustained from Hurricane Ian. For example, most standard homeowner’s insurance policies do not provide coverage for water damage that falls under the purview of a flood insurance policy which must be added as supplemental coverage. Thus, your hurricane insurance claim is not likely to cover flooding or flood damage. However, insurance carriers are notorious for attempting to attribute all types of damage to a flood loss. We will retain top notch experts to combat the insurance company at every step of the way.

Your Insurance Company may not Have Your Best Interest in Mind

In addition to issues such as flood insurance, homeowner’s with significant property damage due to wind, debris, or electrical issues may have issues getting the coverage they need even if the damage does fall under their policy’s coverage. Keep in mind that if you insurance company denies or underpays your claim; we are committed to litigating against them if necessary.

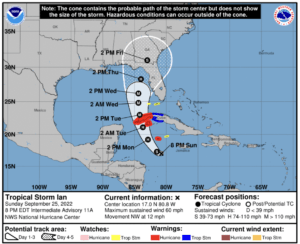

Hurricane Ian Damage Across Florida

Governor Ron DeSantis declared a state of emergency for all of Florida as a result of tropical storm-now Hurricane Ian. Hurricane Ian made landfall near Fort Myers, and tore homes apart with approximately 150 mph winds not to mention an immense storm surge. Cape Coral, Port Charlotte, Punta Gorda and Bonita Springs also sustained immense property damage. Sarasota (60 miles north of Fort Myers) experienced wind gusts that exceeded 100 mph. We have seen entire communities with significant roof and interior water damage over 45 miles from landfall.

Hurricane Ian Caused Significant Wind Damage Including Consistent Roof Damage and Broken Windows Causing Interior Water Damage in the Following Cities:

- Fort Myers

- Bonita Springs

- Port Charlotte

- Punta Gorda

- Cape Coral

- Naples

- Venice

- Englewood

- Sarasota

- Bradenton

- Lakewood Ranch

- Orlando

- Daytona Beach

- Cape Canaveral

- Melbourne

- Cocoa Beach

- New Smyrna Beach

Major coastal cities such as Fort Myers/Cape Coral, Naples, Port Charlotte, Punta Gorda and surrounding towns faced immense storm surges and consequent flooding damage. There is also the damage to property inflicted by wind, rain, and debris. Hurricane Ian left behind a wake of catastrophic property damage worth billions in most counties across the gulf coast of Florida and inland.

We anticipate over 1 million Hurricane Ian insurance claims will get submitted by mid-October. Insurance claims covering a wide array of Hurricane Ian property damage will be filed by both residential and commercial claimants. Our law firm is already representing many residential and commercial policyholders on both coasts. Do not deal with claims adjusters on your own. Adjusters are experienced in low balling hurricane claims. If you suffered hurricane damage, do not go at it alone. Insurance adjusters even deny valid claims resulting in bad faith lawsuits. This is simply part and parcel to how insurance carriers operate.

The following counties are estimated to be the most heavily damaged by the storm.

- Collier

- Lee

- Brevard

- Broward

- Charlotte

- DeSoto

- Glades

- Hardee

- Hendry

- Highlands

- Hillsborough

- Indian River

- Manatee

- Martin

- Miami-Dade

- Monroe

- Okeechobee

- Osceola

- Palm Beach

- Pasco

- Pinellas

- Polk

- Sarasota

- St. Lucie

Insurance companies fight tooth and nail against the onslaught of claims that inevitably arrive after a severe storm such as Hurricane Ian in order to reduce the amount they lose in payouts to clients. Dealing with the denial of insurance coverage for Hurricane Ian-related damages can be devastating which is why homeowners should consider speaking to an experienced hurricane property damage lawyer in a situation such as this. Our hurricane damage lawyers can even the playing field with insurance companies that have more resources and legal prowess than the average person can muster. You can rest assured that Dolman Law Group will ensure your right to fair compensation for hurricane property damage is respected.

Damages You May Recover in Your Florida Hurricane Damage Claim

Hurricane victims are entitled to compensation for their storm-related losses. Florida Statute § 627.70132 allows you to file a claim against your homeowner’s insurance company or sue the property owner (if you’re renting) for any economic damages that result from a storm.

Compensation in a Florida hurricane damage claim comes in various forms, including:

- Loss of belongings, including insurance reimbursements

- Loss of wages

- Medical expenses

- Pain and suffering

- Property damage, e.g., loss of your car

In some cases, you may also be entitled to compensation for additional damages, such as:

- Lost business or income opportunities

- Lost business contracts or sales

- Pain and suffering related to mental distress

If you’ve suffered monetary loss from the storm, please contact a hurricane damage home insurance lawyer for legal help. A lawyer can help by investigating your claim, compiling evidence, filing your claim within the deadline, and negotiating with the insurer on your behalf.

Our Florida Hurricane Damage Attorneys Charge No Money Upfront

We work on a contingency-fee basis at our law firm. We don’t charge you any money upfront to take your property damage case; we only get paid if we settle or win your claim in court. We only receive a pre-determined and agreed-upon percentage of your claim payout from the insurance company.

Our payment agreement means that, while you focus on repairing your home, you:

- Won’t pay anything out-of-pocket

- Don’t have to stress over your attorney’s hourly rates

- Have no financial barrier to retaining legal help right away

- Get access to our resources and legal guidance immediately

- Sleep well at night knowing you have a law firm and an invested legal team on your side

What Is Hurricane Insurance in Florida?

Hurricane insurance can prove tricky to understand. Typically, you cannot purchase a specific insurance policy for hurricane damage. When people face property damage after a hurricane, they typically need to seek a payout through one or more coverages in their policy: windstorm insurance or a combination of windstorm insurance and flood insurance.

Windstorm insurance only covers property damage as a result of heavy winds. Strong winds are typical in hurricanes, blizzards, or tornadoes.

The basic version of this coverage provides payment for things damaged by wind or due to wind, such as:

- Roofs or siding

- Shattered windows

- Battered doors, gutters, or garages

- Damaged structures attached to your home

- Damaged fixtures and features inside your home

- Destroyed personal items

Under state law, homeowners insurance policies must include wind damage insurance for hurricanes. So, your insurance carrier cannot claim that your wind damage is not covered after a hurricane. In other states, however, homeowners must purchase separate windstorm coverage.

Will My Hurricane Insurance Cover Flood Damage?

Getting water damage covered after a hurricane can prove challenging and frustrating for many homeowners. Your homeowners policy should cover water damage if it results from a storm’s wind or another covered peril. However, it does not cover flood damage unless you purchased a separate flood insurance policy. So, if you faced damage from storm surge or other flooding, we can check your policy to see if you have flood insurance.

The covered perils under standard homeowners insurance policies generally include:

- Water damage

- Fire and smoke

- Explosions

- Lightning

- Theft

- Vandalism

- Windstorms

- Hail

- Power surges

- Falling objects

- House damage from aircraft or motor vehicles

- Riots and civil commotion

To receive protection against flood damage, you must have flood insurance. Windstorm insurance and flood insurance protect policyholders against the two major threats of a hurricane.

If your insurance company denies a claim because you do not have flood insurance, we can investigate the situation. In some cases, your water damage may have resulted from a covered peril—even if you don’t have a flood policy. For instance, if you have a hole in the roof from a downed tree and water damaged the attic and walls, we can argue for your coverage under a standard homeowners policy.

Obtaining Flood Insurance in Florida

The United States government provides most flood insurance through the National Flood Insurance Program (NFIP), run by FEMA. You can purchase it directly through the program or an authorized third-party insurance broker. Some private insurance companies may also sell flood insurance.

If you live in an area covered by NFIP, you can buy flood insurance. Homeowners, renters, and commercial property owners can purchase this coverage.

What Type of Coverage Does Flood Insurance Provide?

Flood insurance encompasses two types of coverage:

Building Coverage

The NFIP offers building coverage at a $250,000 limit.

It covers the structure of your home or commercial property and any fixtures, including:

- Foundation walls and anchorage systems

- Staircases

- Attached and detached garages

- Plumbing

- Wiring

- Fuel tanks

- Well water tanks and pumps

- Solar equipment

- Furnaces and water heaters

- Permanently installed carpet

- Permanently installed cabinetry

- Built-in appliances

Content Coverage

You can get content coverage for up to $100,000. It insures your possessions within the home like:

- Air conditioning units

- Carpets not included in building coverage

- Clothes

- Curtains

- Electronic devices

- Furniture

- High-value items for as much as $2,500 (like artwork or antiques)

- Washer, dryer, refrigerators, or other standalone appliances

A Florida hurricane claims lawyer at our firm can ensure all damage to your covered property is accurately itemized, calculated, and included in your claim.

How Is Flood Damage Different From Water Damage?

Flood damage specifically refers to damage caused by a flood.

FEMA defines a flood as:

- A temporary condition;

- A partial or complete inundation of two or more acres of normally dry areas or two or more properties; and

- One of those acres or properties belongs to the policyholder

Importantly, FEMA says the flood must also come from certain sources before damaging your property.

These sources may include:

- A flash flood

- Storm surge

- Broken dams

- Overflowing rivers

- Collapse of land along the shore

In other words, you cannot get FEMA coverage for a flood from a lack of maintenance within your own home. For example, if a slow-leaking pipe in your bathroom floods your home, you do not qualify for FEMA coverage.

Reasons an Insurer May Deny Your Hurricane Damage Claim

Unfortunately, putting in the time to file your claim doesn’t guarantee its approval. For many reasons, your insurance carrier may deny your claim or offer less than you wanted.

You may have:

- Provided information that misrepresented your hurricane damage

- Missed the deadline to file your claim

- Failed to mitigate additional damage

- Claimed damage the insurer believes is unrelated to the hurricane

- Supplied insufficient documentation of the damage you sustained or proof of ownership.

We know it’s frustrating to have your claim denied, but it’s not the end of the road. One of our lawyers can file an appeal for you. Your lawyer can review your denial letter and work to refute the insurer’s allegations with solid evidence.

The attorneys at Dolman Law Group understand how quickly you need your money. We know that the longer it takes to receive funds, the more hardships you and your family may face. You’re counting on your insurance claim money to pay for repairs to secure your home, get your business back up and running, cover the cost of hotel stays, or replace essential items.

You need the money to put your life back together after a devastating storm. So, we work hard to get your claim settled as quickly as possible. That means stopping an insurer’s bad faith practices that unfairly prolong your payout.

Our Hurricane Damage Attorneys Can Sue the Insurer for Mishandling a Claim

Insurance companies sometimes mishandle claims. When they do, Florida law allows you to file a lawsuit for breach of contract and/or bad faith. For example, if the insurer fails to fulfill their end of the bargain under your insurance policy, you can file a lawsuit for breach of contract. This might prove necessary if the insurer refuses to approve losses covered under your homeowners or flood damage insurance policy.

When insurance companies conduct themselves unethically, the law provides for a bad faith lawsuit. Failing to respond to your claim is one example of bad faith.

In general, we can file a lawsuit against the insurer for the following actions:

- Failure to respond to claims within a reasonable amount of time

- Failure to adjust claims in a reasonable timeframe

- Failure to payout claims fairly

- Misrepresenting the law

- Lying about or misrepresenting the provisions of your insurance policy

- Denying your claim for no justifiable reason

- Failure to notify you of the limits of your coverage

- Failure to provide essential information

- Refusing to supply information and documentation you have a right to

If you face issues with an insurance claim, tell us what you’re dealing with. We can explain your legal options if your insurance company’s actions constitute bad faith. We can help you go after the compensation you deserve.

The Statute of Limitations for Florida Hurricane Insurance Lawsuits

If your homeowners insurance company engaged in bad faith conduct or breached their contract, you generally have five years to file a lawsuit under Florida law. Time passes quickly, so we encourage you to get started with your case by contacting an attorney right away.

It will take dedicated time to build a case that can withstand a trial if it comes to that. Delaying legal action could risk running out of time. Ultimately, you could lose your right to recover compensation from your insurance company, leaving you to bear your hurricane damage alone.

Is There a Deadline for Filing a Hurricane Insurance Claim in Florida?

Under Florida law, you must file your hurricane damage claim within two years after the date of loss. Therefore, if your claim was previously closed, you have to reopen it within two years from the initial loss. However, if you file a supplemental claim for damages you did not know about, you have three years from the date of loss to submit it.

How Long Do Hurricane Damage Claims Take to Settle?

Just as you have a deadline to file your insurance claim, the state also imposes deadlines on your insurance company to adjust your claim. Several laws exist to protect you from unfair delays in receiving a payout of your hurricane insurance claim. You have a right to fair and timely claims adjustment according to various statutes, as listed in Florida’s Homeowner Claims Bill of Rights. The bill of rights also enumerates your responsibilities as a policyholder.

According to Florida law:

- You must receive a written response to your insurance claim within 14 days of filing. The written acknowledgment should include your next course of action.

- After you make a written request, your insurance agency must confirm if they will cover your hurricane damage, partially cover it, or deny your claim. This must be done within 30 days of you submitting proof of your damages.

- Within 90 days from the date of your hurricane damage claim filing, your insurance provider must fully pay your claim, pay the uncontested portion of it, or deny your claim in writing unless extenuating circumstances exist that stop the insurer from taking one of those actions.

- If your hurricane insurance claim isn’t denied but has still not been paid in full or in part within 90 days, the insurer must pay you interest. The interest accumulates from the day you filed your claim to when you receive payment for the claim.

After You Settle, the Insurer Must Pay Your Hurricane Damage Claim Quickly

Once you reach a settlement agreement with the insurance company, you can expect the check to arrive soon. Florida law requires the insurer to disburse your payment within 20 days of a written settlement agreement. If the insurer fails to do so within the state’s timeframe, the insurer will pay interest at 12 percent a year until paid.

A Florida hurricane damage lawyer at Dolman Law Group can remain on top of your case to keep track of all legal deadlines. We can respond accordingly to any delays from the insurance company that violate your right to fair and timely compensation under your policy.

Follow These Steps in Case of Hurricane Damage

If a hurricane battered your home or another property, you’ll need to take steps to help with your hurricane damage claim and ensure your property is as secure as possible.

Ensure Safety

If you must leave your home or your property lies in an evacuation or disaster zone, wait for authorities to declare the area safe. Once you have the go-ahead to return to your property, you should do so with caution.

The same holds true if you rode out the storm. Stay vigilant about your safety, being mindful of standing water and the presence of downed power lines, live electrical wires, and plugged-in electric appliances or devices. Avoid debris and shattered glass as you survey your home for damage.

Document the Damage

Perform a thorough assessment of your home or commercial property. Check windows, walls, floors, ceilings, and doors for damage. Survey each room, one by one, taking photos and video recordings of damaged structures, fixtures, and possessions.

Take photos from multiple angles to give a complete view of the damage. Make sure you get clear shots and video. You will need to attach them to your claim as evidence of your losses. You may have a lot of property to work through, so set aside time and pace yourself so you don’t get overwhelmed. Know that you must document the damage before cleaning up or throwing items away.

Salvage what you can. If you have items to save, do your best to place them aside somewhere safe and separate them from damaged property.

Emergency Clean-up Only

After you record photos and video of the damage, you can begin cleaning up to make your home safe and comfortable again. If you cannot inhabit or use the space, clean up enough to mitigate further damage, safely maneuver through the property, and eliminate any health hazards you can handle. Tarp any holes in the roof to prevent further water damage.

Avoid throwing away items and pieces of property as much as reasonably possible or necessary. The insurance adjuster may need to do an in-person assessment later, so you don’t want to throw anything important away.

Contact Your Insurance Agency

You’ll need to file a claim. You can call the insurance company to notify them about your hurricane damage and ask for your next steps. You can usually find this information on the insurance company’s website as well.

You can obtain a claim form and send it by mail. Alternatively, you can download a copy of the form from the website and submit it electronically. If the insurance company provides the next steps before you file your claim form, follow them carefully. If you do not know what you should include with your claim, a lawyer from our team can help.

Keep Track of Your Hurricane Damage Expenses

Keep a record of any expenses you have related to your hurricane-damaged property.

For example, save bills, receipts, and invoices for:

- Temporary repairs

- Purchased supplies

- Help you hired

- Equipment or moving truck rentals

If you have to relocate temporarily or indefinitely as a result of the damage, save any transaction receipts, confirmation emails, and documents in a single place.

Call a Hurricane Insurance Claims Lawyer

Dealing with an insurance claim can add more stress to your life while trying to stabilize yourself after a storm. Trying to make sense of a complex insurance policy while gathering documents and coordinating the repair of your home can feel harrowing. Compounding the problem, the insurance company may offer you a low payout or neglect your claim altogether. Our hurricane damage lawyer can take over the claim process for you, deal with the insurance adjuster, and fight for your fair and full payout.

The hurricane insurance claims process will flow much smoother if you follow these steps. Your Florida hurricane damage attorney can help you properly navigate the process to file your claim.

Don’t Handle Your Florida Hurricane Damage Claim Alone—Call Dolman Law Group

It’s natural to feel overwhelmed by the insurance claim process. Facing the aftermath of a hurricane can leave you with little room to fight. You don’t have to do it alone. A Florida hurricane damage lawyer at Dolman Law Group stands ready and equipped to take on your claim and the insurance company for you. We can handle your case from start to finish, and we fight for the results you deserve.

No matter what part of the process you now face, you can place your claim in our hands. Don’t wait to restore your home, your business, or your life. Contact us today for a free case evaluation: (727) 451-6900. We know how to help.